Fascination About Hard Money Georgia

Wiki Article

An Unbiased View of Hard Money Georgia

Table of Contents7 Simple Techniques For Hard Money GeorgiaFacts About Hard Money Georgia UncoveredThe 5-Minute Rule for Hard Money GeorgiaThe smart Trick of Hard Money Georgia That Nobody is Discussing

As you can see, exclusive money finances are exceptionally adaptable. It might be said that private finances can place both the lender as well as consumer in a sticky circumstance. Claim the 2 celebrations are brand-new to genuine estate investment. They may not recognize a lot, but they are close to each various other so want to help each other out.

In spite of them requiring to satisfy specific standards, exclusive borrowing is not as managed as tough cash fundings (in some situations, it's not controlled at all).- Experienced financiers understand the advantages of enhancing their personal money sources with a difficult cash lender.

The 4-Minute Rule for Hard Money Georgia

Above all, they're licensed to provide to actual estate investors. Probably a mild disadvantage with a hard money lender associates to one of the characteristics that links private and also difficult cash financings policy.Nonetheless, depending upon just how you consider it, this is also a toughness. It's what makes hard money lending institutions the safer choice of the 2 for a first time financier and also the factor that savvy financiers remain to go down this course. WE LEND OFFERS A VARIETY OF PROGRAMS TO MATCH EVERY SORT OF RESIDENTIAL INVESTOR.

Everything about Hard Money Georgia

It's typically possible to obtain these kinds of financings from exclusive loan providers that don't have the same requirements as conventional loan providers, these private lendings can be more pricey as well as less advantageous for consumers, since the danger is a lot greater. Conventional lenders will certainly take a thorough consider your entire financial scenario, including your income, the quantity of financial obligation you owe other lenders, your credit rating, your various other assets (consisting of cash reserves) as well as the size of your deposit.

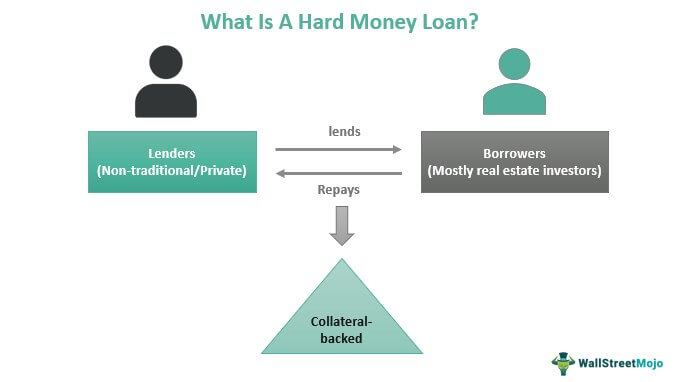

Tough cash car loans have numerous benefits over business loans from financial institutions and also various other mainstream loan providers. Are difficult money lendings worth it? Under the ideal circumstances absolutely.Fast funding can be the distinction in the success or failing of an opportunity. Difficult cash lending institutions can turn a finance application right into offered cash money in an issue of days. Do hard money loan providers inspect credit scores? Yes, yet they concentrate on security over all else. They do not evaluate a customer's credit score merit in the same way as more regulated sources of funds. Lower credit history and also some negative marks in borrowers'financial histories play a smaller function in the lending institution's authorization choice. In situation of default, the lending institution must be assured that the profits from sale of the building will certainly be sufficient to redeem the financing's overdue major equilibrium. To some degree, also the debtor's ability to repay the lending during the term is much less vital than various other making a decision elements. However, the lender has to make certain the debtor can make the needed payments. Less state and federal regulations control tough money lenders, which permits for this flexibility. Because of the Dodd-Frank Act, tough money lending institutions normally do not lend for the acquisition of a primary house. Difficult cash finances are a sort of different financing

that can be made use of genuine estate financial investment chances. Unlike traditional financings, which are provided by financial institutions or other banks and are based primarily on the debtor's creditworthiness and also income, tough money lendings are released by private financiers or companies and also are based primarily on the value of the building being utilized as collateral. It uses the borrower an option to the usual mortgage programs or traditional lending institutions. One of the most typical use of these financings are with repair & flips and also short term funding requirements. The hard cash lendings that we provide are elevated via small personal capitalists, hedge funds, and also other personal click site establishments. As a result of the threat taken by the financing suppliers, interest rates are typically more than the ordinary home mortgage. Our items have shorter terms as well as are generally for 6 months to 5 years, with passion just alternatives as well as are not suggested to be a long-term financing remedy. Custom Mortgage Hard Cash Finance Programs Include the following primary program: 1-4 System Residential Characteristic consisting of Apartments, condominiums, apartment or condo houses, as well as other unique residential properties. This is because difficult money lenders are primarily concentrated on the worth of the property, instead of the consumer's credit reliability or earnings. Therefore, hard cash finances are commonly utilized by real estate capitalists that need to secure financing promptly, such as in the instance of a repair as well as turn or a short sale. This consists of single-family residences, multi-unit residential properties, industrial residential or commercial properties, and also even land.

Some Known Details About Hard Money Georgia

Additionally, difficult money financings can be used for both purchase and refinance deals, along with for building as well as remodelling jobs. While tough cash financings can be an useful device for real estate investors, they do come with some disadvantages. In spite of these downsides, tough cash loans can be an useful device genuine estate financiers. If you are taking into consideration a hard moneycar loan, it is essential to do your study and find a reliable lender with competitive prices and also terms. Furthermore, it is very important to have a clear plan in position for exactly how you will make use of the financing earnings and how you will exit the investment. In verdict, tough cash lendings are a kind of alternative funding that can be utilized for real estate financial investment opportunities. They are released by personal investors or business and are based largely on the value of the residential property being used as security. One of the primary advantages of difficult cash finances is that they can be obtained swiftly and quickly, frequently in just a few days. Difficult cash car loans commonly have greater interest rates as well as costs than traditional finances, and also have shorter terms. Customers must carefully consider their choices as well as have a clear strategy in area before committing to a hard money financing. These lendings are suitable for the people who are credit history damaged. This is because, as long as you have excellent security, the hard car loan lending institutions will certainly supply you a lending even if you are bankrupt. The loans are also optimal for the foreign nationals who will not be provided finances in various other establishments given that they are non-citizens of a given country. One excellent benefit is that the This Site lendings are simpler to gain access to; for that reason, if you do not meetthe credentials of the conventional loan provider, you can conveniently access the financing without going through rigorous paperwork. These lending institutions use actual estate capitalist financings along with the rate as well as convenience benefits that difficult money gives, yet with even more trustworthy closings as well as better openness and also service through the procedure. Personal lending institutions generally have a lot more funding to deploy and also a lot more reputable access to funding than hard cash loan providers. i thought about this These are two massive reasons that capitalists thinking about hard cash ought to explore personal lenders as well as especially.( Last Upgraded On: June 1, 2022)There are many funding options for actual estate financiers available today. Among the most prominent alternatives has come to be the hard cash car loan. A hard cash car loan is a car loan collateralized by a difficult property (in many instances this would be property).Report this wiki page